Summary

- Nonrevolving credit declines slightly.

- Revolving credit edges up.

|

|

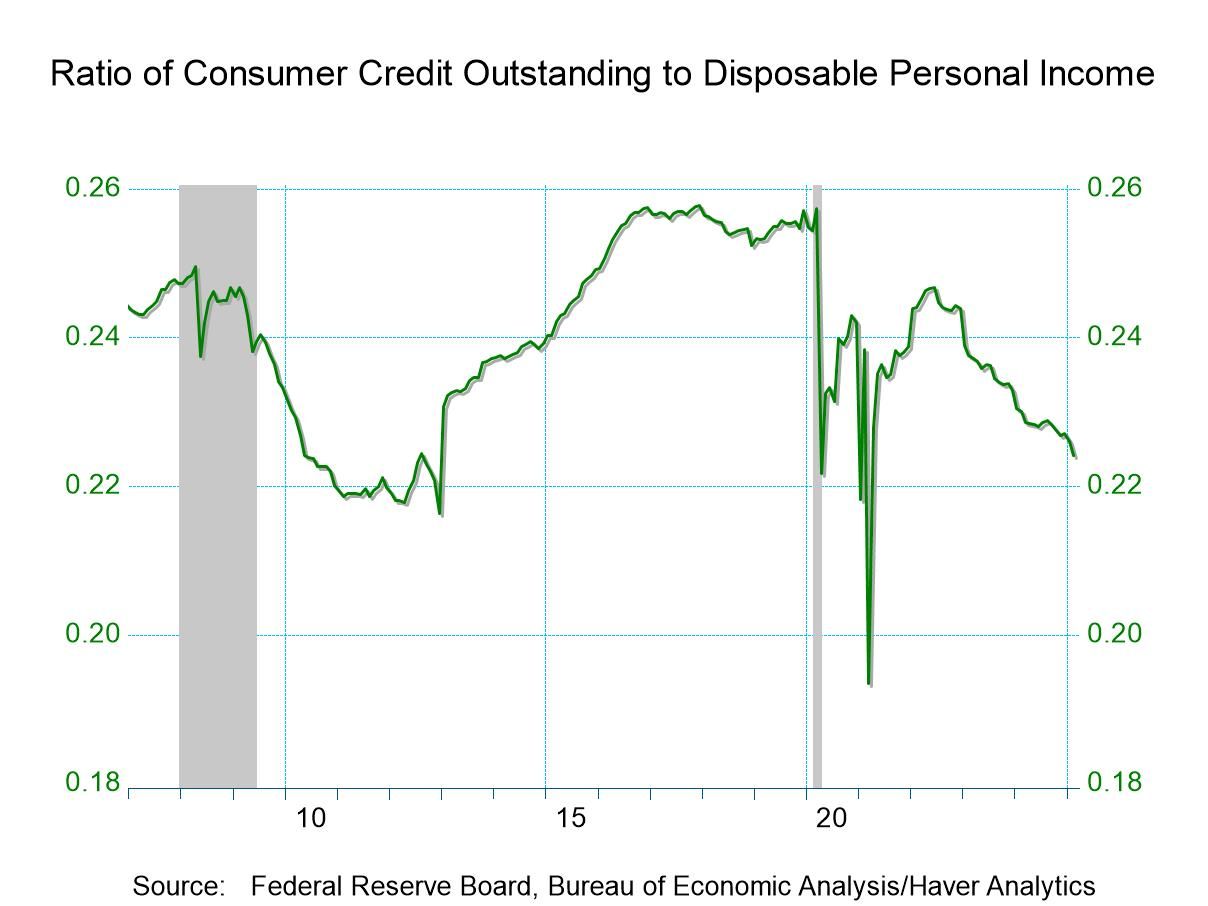

Consumer credit outstanding eased $0.8 billion (+1.7% y/y) during February after rising $8.9 billion in January. A $15.0 billion rise had been expected in the Action Economics Forecast Survey. As a percentage of disposable personal income, consumer credit was 22.4% in February, compared to 23.0% one year earlier.

Nonrevolving credit outstanding eased $0.9 billion (+1.2% y/y) in February after rising $2.4 billion in January. Nonrevolving credit held by depository institutions declined 9.0% y/y in February. Finance company debt holdings rose 1.2% y/y while credit union holdings eased 2.2% y/y in February. Nonrevolving debt held by the federal government rose 3.4% y/y.

In February, revolving credit, which includes credit cards, edged $0.1 billion higher (3.0% y/y), following a $6.6 billion January rise. Revolving credit outstanding held by depository institutions fell 1.5% y/y. Revolving credit held by finance companies fell 7.9% y/y, while that held by credit unions rose 5.1% y/y.

The consumer credit figures from the Federal Reserve Board are break-adjusted and calculated by Haver Analytics. The breaks in the series in 2005, 2010 and 2015 are the result of the incorporation of data from the Census and the Survey of Finance Companies, as well as changes in the seasonal adjustment methodology. The consumer credit data are available in Haver’s USECON database. The Action Economics forecast figures are contained in the AS1REPNA database.

|

|

Comments are closed.