|

Global monetary reflation is once again underway. The United States, the European Monetary Union, and the United Kingdom are all our participants; Japan is the country going its own way continuing to tighten and to restrict policy through disciplined and tightening monetary growth.

Reflation afoot

Among the other three countries that are showing monetary stimulus, the U.K. is leading the way with the sterling M4 growth rate up to 7.6% at an annual rate over three months. The U.K. data lag other data in the table; they’re not up to date through April; still, the acceleration is quite apparent over three months. Over 12 months, U.K. money growth is 3.5%, U.S. money growth is 4.4%, and the European Monetary Union money growth rate is 3.6%. The annual numbers still represent reflation increases in the annual growth rates compared to where they have been in the last three years, although none of the year-over-year growth rates really look like they are yet excessive compared to inflation targeting plans and likely GDP growth rates. However, this is definitely a transition to reflation. The question is whether it will be tempered at the right point.

EMU trends

In the European Monetary Union, the two-year growth rate and the three-year growth rates for money are under 2% while the 12-month growth rate is up to 3.6%. Monetary Union growth rate of real money balances is up over three months at 2.3% at an annual rate and at 1.5% over 12 months. European credit growth is picking up, as well, with private credit growth running at a 2.5% annual rate over three months and at a 2.3% pace over 12 months; in real terms, private credit growth year-over-year, however, is only 0.2%.

U.S. trends

In the United States, money growth is up to 6.5% at an annual rate over three months, money growth has progressed from averaging 0.2% over three years, to 2.7% over 2 years, and now to 4.4% over 12 months. U.S. nominal money growth clearly is accelerating. Looking at the growth of real balances in the U.S., the real money stock is growing at a 4.9% annual rate over three months and at 2.1% at an annual rate over 12 months.

U.K. trends

In the United Kingdom, there is that 7.6% three-month growth rate that compares to 3.5% over 12 months and to slower growth over 2 and 3 years. Real balance money growth is at a 3.3% annual rate over three months; over 12 months, the U.K. growth rate for real money balances is flat! While the U.K. seems to be in a period of relatively sharp acceleration for money growth, it’s not yet a long-lived period of expansion, and so that has not yet had much impact on actual inflation developments. But the jack-rabbit start to monetary acceleration is something to be wary of.

Japan trends

In Japan, M2 plus CD’s is falling at a 2% annual rate over three months, and rising at only a 0.4% in an annual rate over 12 months. That represents a lower growth rate than its two-year or three-year growth rate for the money stock. In terms of real money balances, over three months Japan’s real balances are shrinking at a 3% annual rate, the same as the 12-month growth rate. Japan clearly is using monetary policy to squeeze inflation lower.

Oil

Disinflation efforts have been helped everywhere by oil prices that are falling in dollar terms at a 48.3% annual rate over three months and falling at a 24.6% annual rate over 12 months.

Global monetary reflation…except Japan

The central bankers club

Central banks have been busy lowering interest rates because inflation rates have been coming down after a long period of inflation excess; bankers are clearly right now trying to manage the transition between excessive inflation to sustainable growth. But they are doing so at a time when there’s a tremendous amount of uncertainty lingering because of the Russia-Ukraine war, because of shifting geopolitical alignments and responsibilities, and – significantly – because of U.S. tariff policy that has injected a lot of uncertainty into the outlook.

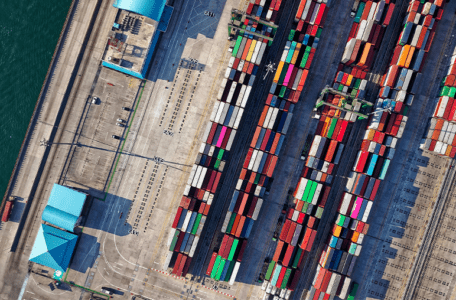

Tariffs

The uncertainty over U.S. tariff policy is substantially about uncertainty over what the U.S. is trying to achieve. At various points, the U.S. has talked about generating tariff revenues and other times it has talked about getting foreign countries to peel back their own tariffs. If the U.S. uses its tariff tool to reduce tariffs globally, this will turn out to be a pro-growth disinflationary move rather than an inflationary move. But the suspicion is that even if the U.S. is able to gain some tariff reform, it’s going to leave more tariffs in place than what it had before it began its tariff gambit. That probably rises inflation risks somewhat.

Risks faced by central banks

The dangers for central banks in this are many because the U.S. currently has overshot its inflation target for over 4 years and other central banks have had similar experiences with their own inflation targeting… and missing. It’s hard in this environment to argue that the central banks have credibility as inflation fighters after the way they’ve missed their targets in the post-COVID period. Not only did they miss their targets because it was a difficult period to make policy, but they missed their targets because they simply did not expend the energy and discipline required to hit those targets. This should take a toll on their credibility. So now with money supply growth picking up, and interest rates being pared back, under threat that tariffs will be raising price levels in the near term, the risk of inflation is all the greater. Central bankers need their credibility but it is eroded. These policies begin to look like central banks are willing to engage in a strategy of reflation and if it backfires into inflation they will simply blame it on tariffs. After all, during COVID, many of them simply blamed the inflation on COVID and on fiscal policy. There have been several papers trying to exonerate the Federal Reserve or to argue that the policy that it made that appeared to respond too slowly to inflation actually wound up making superior policy compared to the Fed following a more conventional consistent anti-inflation strategy. Central bank apologists proliferate.

Central bankers

Central banks have become more powerful during this period. Even if they remain under the pressure of criticism. Meanwhile, there have been significant political changes with new political parties taking hold across many European countries, in the U.S., and in Japan. With new economic policies, new views, and a new set of people in charge of economic policy, it becomes even harder to decide how the inflation growth trade-offs are going to play out in the future. Central banks largely have missed their inflation targets over the last four years and while we have been through a period in which inflation rates have been falling from those heights, inflation rates still do not look tame with respect to their targets. Yet, central banks do not appear to have any fire in their belly to hit their targets and now we have monetary reflation afoot as countries continue to suffer from fiscal excesses in the wake of COVID with little evidence that they will implement any newfound austerity to rein in the excesses that supported growth during the pandemic.

Comments are closed.